Web AI Solution Helping Medium and Large Enterprises Save Millions by Eliminating Double Payments

Many large companies are confronted with considerable financial losses due to duplicate invoices. Even with an in-house department to deal with the issue, the problem still needs a better solution… a digital one.

One such case is of a large French bank, that funded an in-house business incubator to facilitate the research and development of digital solutions to help them find better workflows to their processes.

This is how pAID Analytix was born: a web-based application which uses Artificial Intelligence to identify duplicated invoices and eliminate the human error and the financial loss.

ABOUT THE CLIENT

Our client has over 150 years of experience in the banking and finance world and today is one of the leading European financial service groups, supporting over 31 million individuals through their services.

https://www.paidanalytix.com/

Industry

Banking

Location

Paris, France

Duration

6 months

Technologies used:

THE CHALLENGE

Large corporations with millions running through their cash flows, are not aware they may be losing up to 1% of their payments due to duplicate payments and other types of errors.

Even with large, in-house financial departments, medium and large sized companies still lose money. The large amount of information that has to be processed is prone to human error and not only. Even software programs can return errors which translate in thousands of euros lost.

Even with a dedicated department for checking invoices, the processes for large companies is still generating losses and takes a lot of time. The traditional Excels files with formulas are not enough anymore and a digital transformation solution for the finance industry was needed.

Millions saved from payment leaks since using PaidAnalytix

OUR SOLUTION

We knew we had to develop a tool that could process a lot of information in a very… intelligent way. So what better way than Artificial Intelligence (AI) to make it happen?

The web app was developed in .NET, C# for the back-end and in Angular for the front-end.

AI Solution for the Strict Financial Field

Probably everyone agrees that finance doesn’t leave space for mistakes. Even the slightest ones can lead to millions lost and no one wants that.

We knew that we needed more than just an algorithm that could “get the job done” - we needed something that could outsmart the human error and learn from it.

We have collaborated with another service provider in order to develop and integrate a Machine Learning module that would process and predict the invoice duplicates with a higher degree of accuracy.

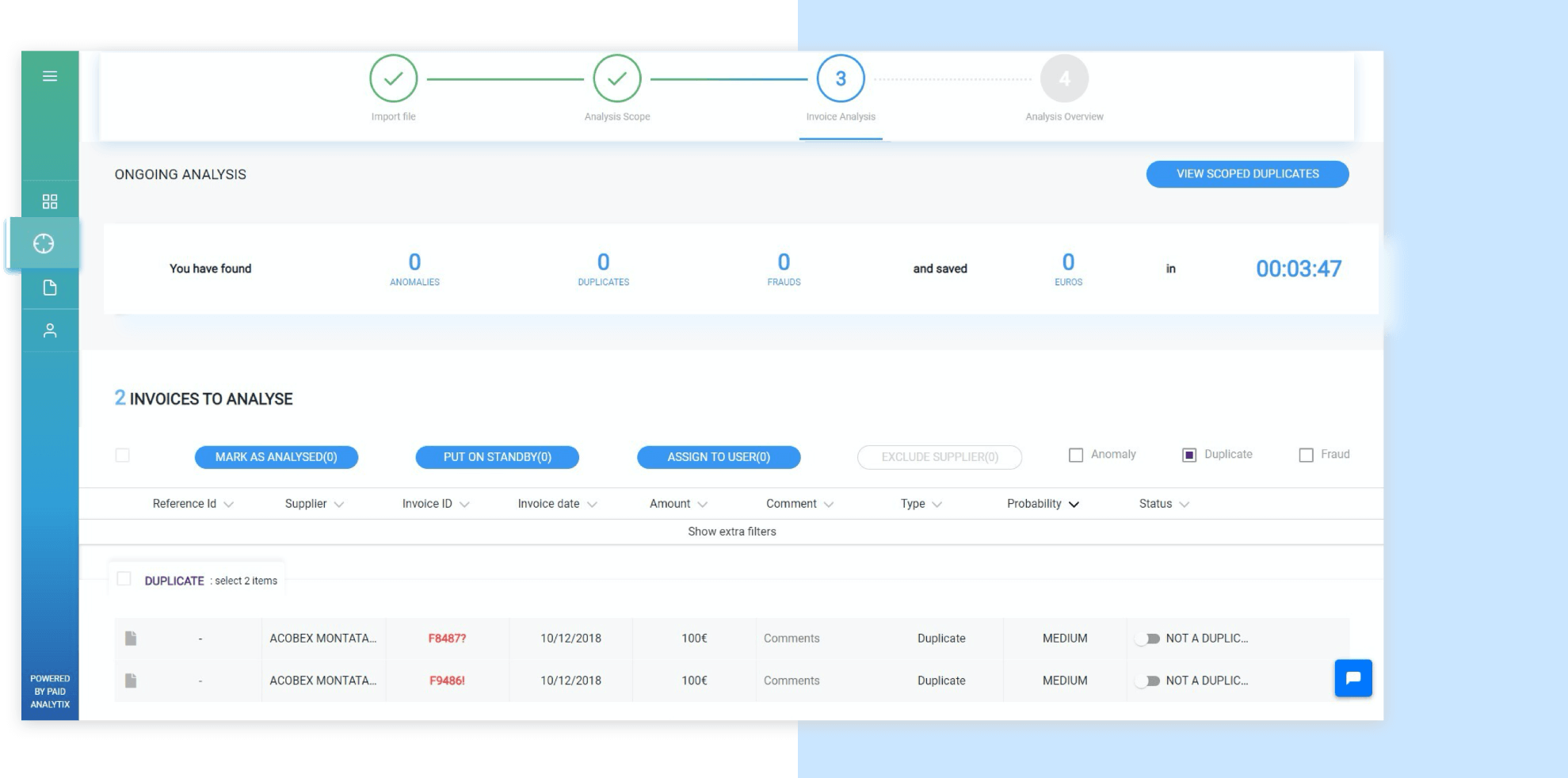

The module analyzes the historical and current invoices and returns notifications about the possible duplicates. This helps users find the issues a lot faster, rather than wasting the user’s time checking every suspicion of error in the traditional way.

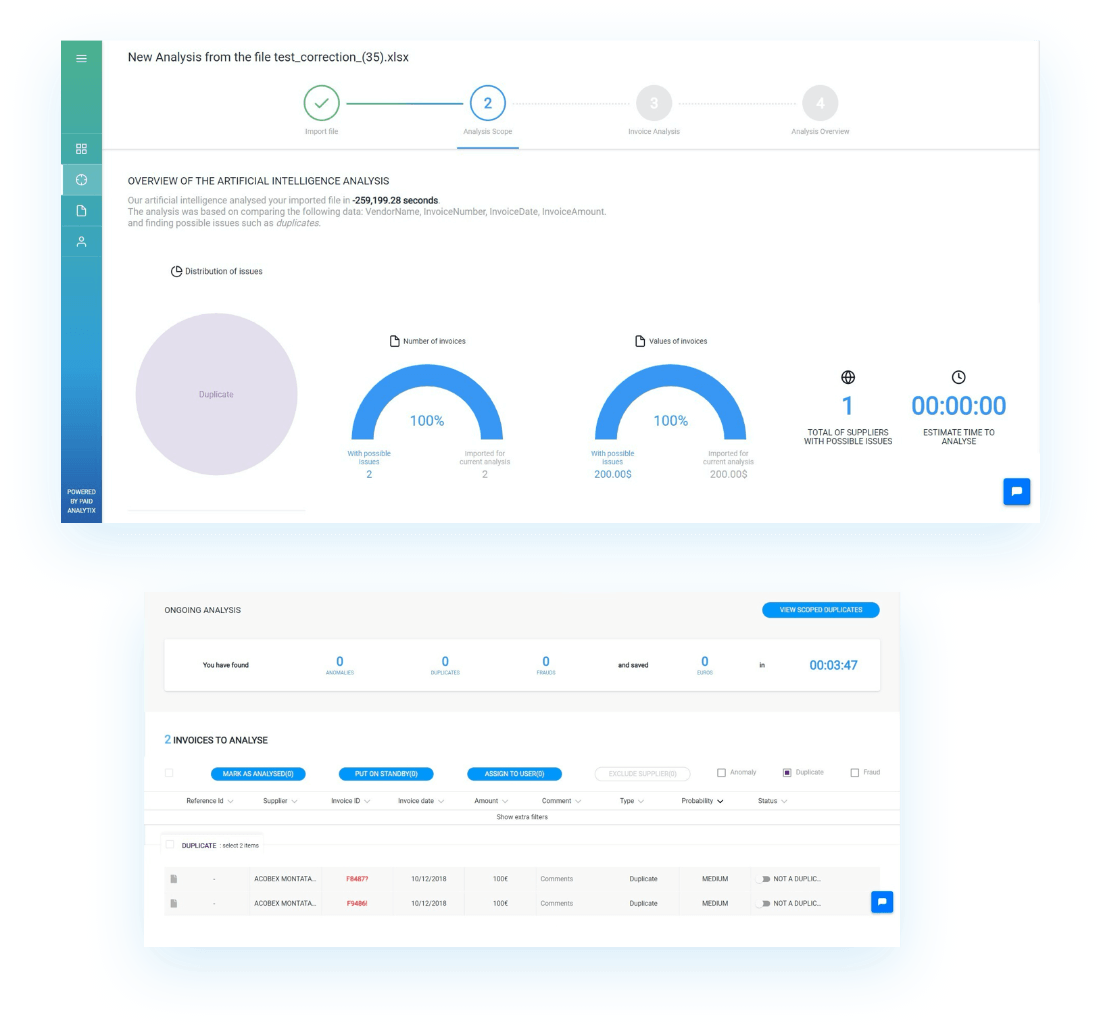

This is how it works in visuals:

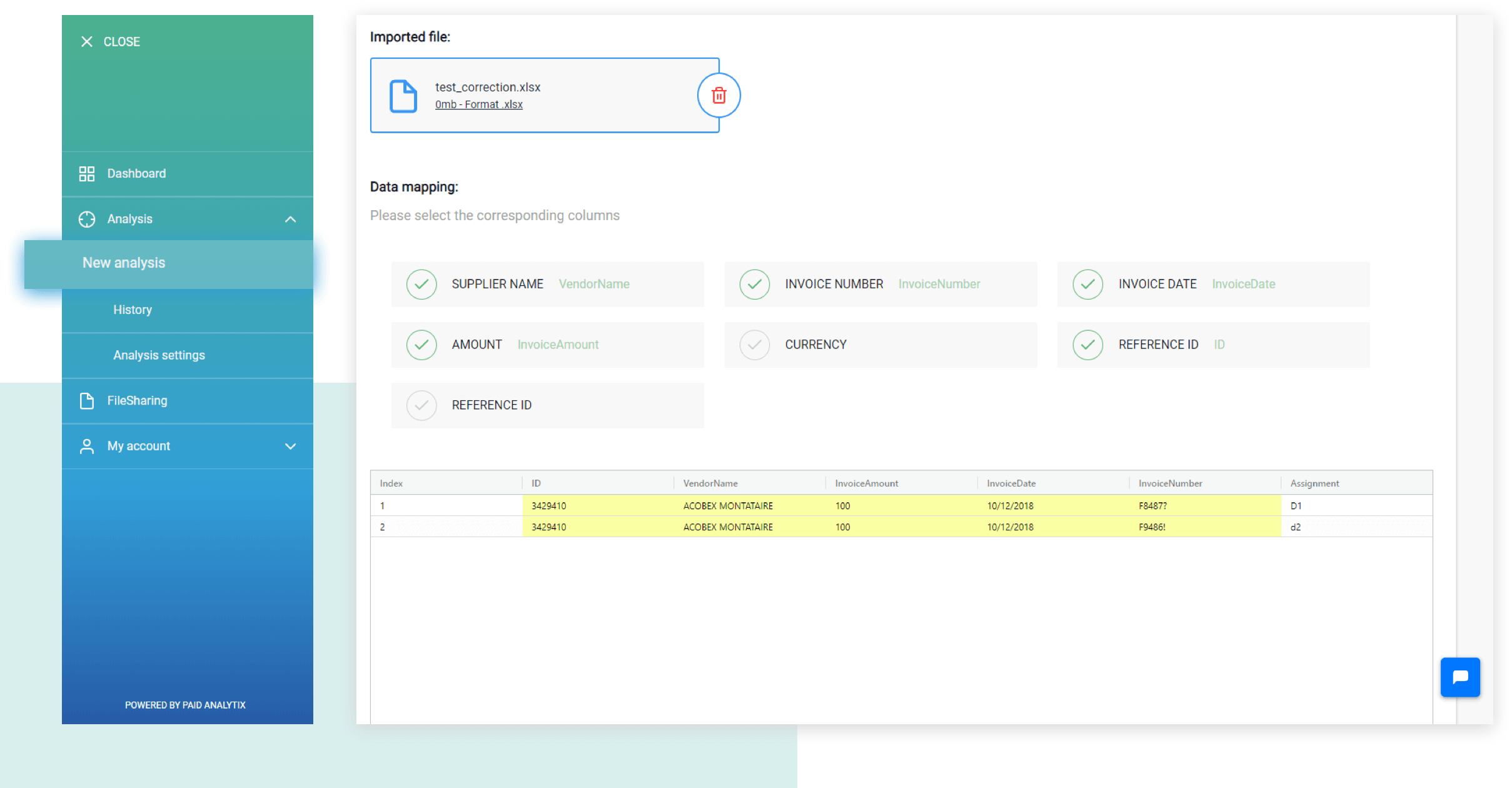

1. Data integration

We are consolidating the customer’s data both quantitative and qualitative. Our solution can process different types of files with the possibility to customize the structure.

2. Business context

We offer the possibility to add new criterias or to create new modules based on the business needs of our clients.

3. Machine Learning

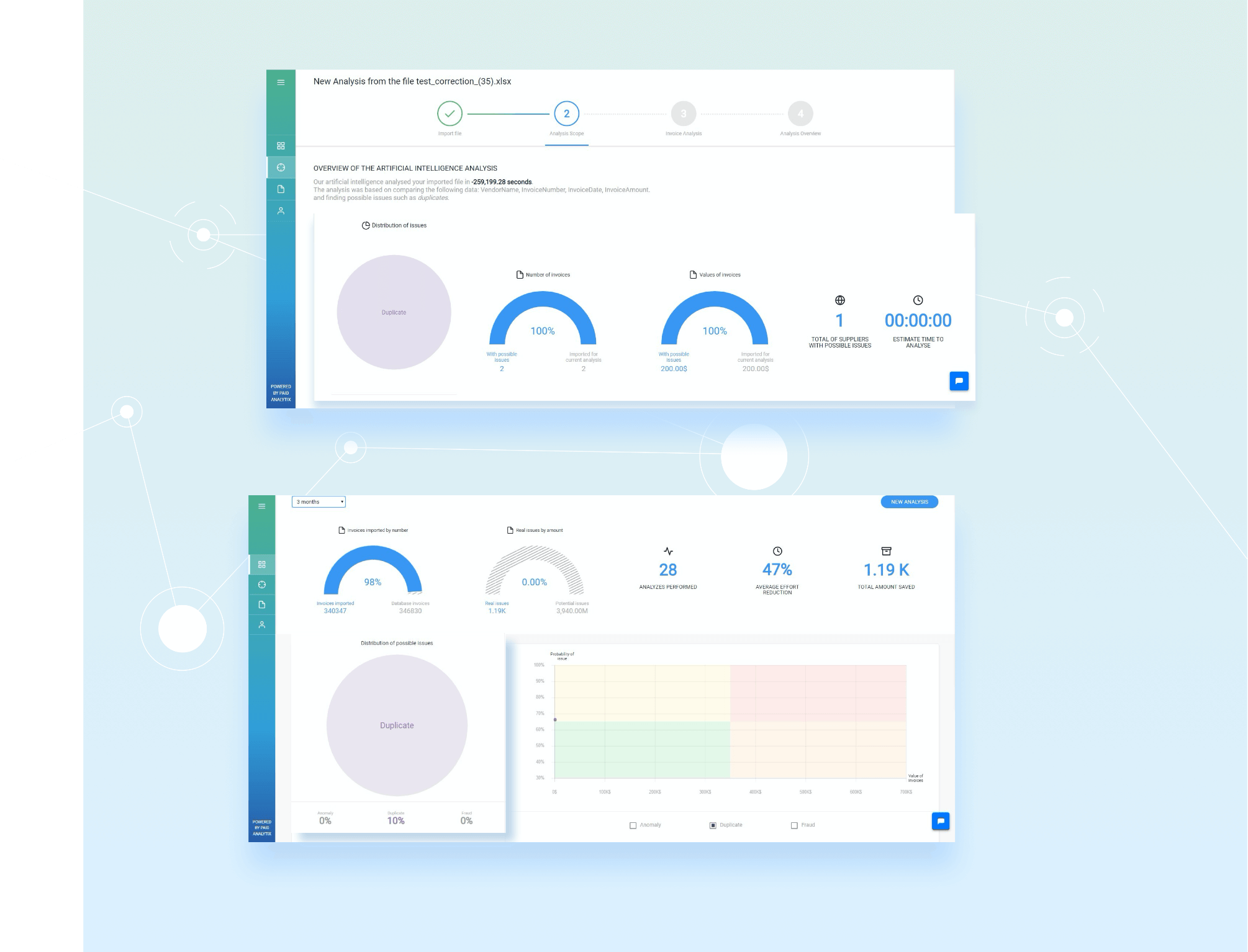

Our ML engine processes the data and provides outcomes with a significant higher accuracy.

4. Review of results

The visualisation of the outcome is customised to ensure maximum efficiency of the analysys.

5. Reporting

We propose to our customers a set of KPI’s for visualising the added value of using our solution, also we give them insights on their own process.

Friendly Interface for Strict Numbers

Having a friendly, intuitive and dynamic interface was very important for our client. We both wanted to bring extra friendliness to the rigid-looking Excel chart that most finance people were used to. So we developed dynamic and easy-to-understand charts that make the user experience enjoyable.

Accessible Anywhere But Highly Private

Each client who uses the app, gets its very own independent environment and data storage space. This allows the users to set up the system either on the pAID Analytix cloud or onto their premises.

This basically means that one company’s data has zero chances or getting mixed up with another company. Also, we know how strict banks or large organisations are when it comes to data leaks, so our infrastructure offers them the right environment that addresses all their security concerns.

Due to the fact that all the data is stored on cloud servers, accessing the app it’s made easy from any location the client will have.

We made the support feature smart and accessible through integrating Drift with the pAID Analytix web app. Users just type in a few keywords and the chatbot will give them automated answers or redirect them to a support agent.

Bank-Level Security

Since the app is processing sensitive information that no company would want public, we made sure the app was bullet-proof when it came to cyber security.

The app was audited by Orange Cyber Security who has run penetration tests and vulnerability assessments. A further test and counter audit was performed by our client’s security department concluded that pAID was highly secure.

Another security level is the individual instances for each client access. In the very unlikely case of a cyber security breach, only the concerned instance would be affected, keeping the other ones independent and safe.

RESULTS

pAID brings a digital, user-friendly, highly secure and fast solution to a financial problem most large companies have to deal with.

The app is intuitive, has a friendly interface and synthesises information in beautiful graphics. Users get notifications when their analysis is complete and can have the whole team managing the invoices.

Our web app helps clients save up to $1MIL of their payments with simple actions like uploading files and pressing a few buttons.

NUMBERS DON'T LIE

80%

Less Operational Effort

$1M

Saved for Every $100 Million Spent

$20B

Analyzed per Year

1.6M

Analyzed Transactions

Got a similar idea?

Let’s talk about how you can implement it!

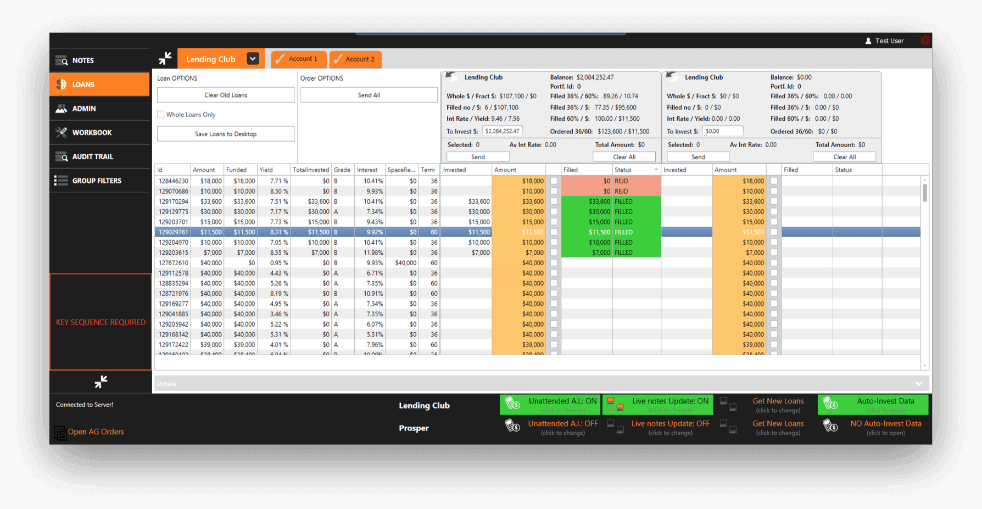

Automated Trading Software for Peer-To-Peer Lending Investments

Distributed client-server platform, facilitating automated investments in Lending Club and Prosper, while increasing the order execution fill ratio by 50% due to the high speed algorithms developed.