Automated Trading Software for Peer-To-Peer Lending Investments

Asset Management LLC needed an automated investment tool to increase the performance of purchasing consumer loans from the Lending Club and Prosper platforms. That would completely replace low-speed spreadsheet (Visual Basic) applications in getting and filtering listings, applying credit models, and sending orders to the platforms.

Their secondary need was do build a data warehouse that would provide rich business-intelligence dashboards and client service reporting.

ABOUT THE CLIENT

Pier Asset Management LLC is a California Registered Investment Advisor who facilitates access to the alternative lending industry for institutional investors.

Founded in 2017, the women owned and operated firm manages private funds, separately managed accounts, and custom solutions providing investors experienced fiduciary oversight in the attractive marketplace lending asset class.

https://www.pieram.com/

Industry

Fintech

Location

Los Angeles, USA

Duration

4.5 years

Technologies used:

THE CHALLENGE

The client's goal was firstly to create a proprietary technology that would automate the process of analysis, loan ordering, and record-keeping, which were reliant on human analysts and spreadsheet software. They realized that this time-consuming workflow could be optimized and sped up by automation, to increase competitive advantage and order-fill rates.

They needed something built to connect to the Lending Club and Prosper APIs, to visualize and automatically extract loan listings, filter them, apply their credit model to the eligible items, calculate yield, quickly make purchase requests, and then provide reports that would enable analysts to observe and improve performance over time. These operations had to perform in milliseconds, to place the orders ahead of the competition.

Secondly, the client required a data warehouse that would serve as the institutional-quality back-end for all of their ad-hoc analyses, rich business intelligence dashboards, and business-critical monthly accounting and client service reporting processes.

OUR SOLUTION

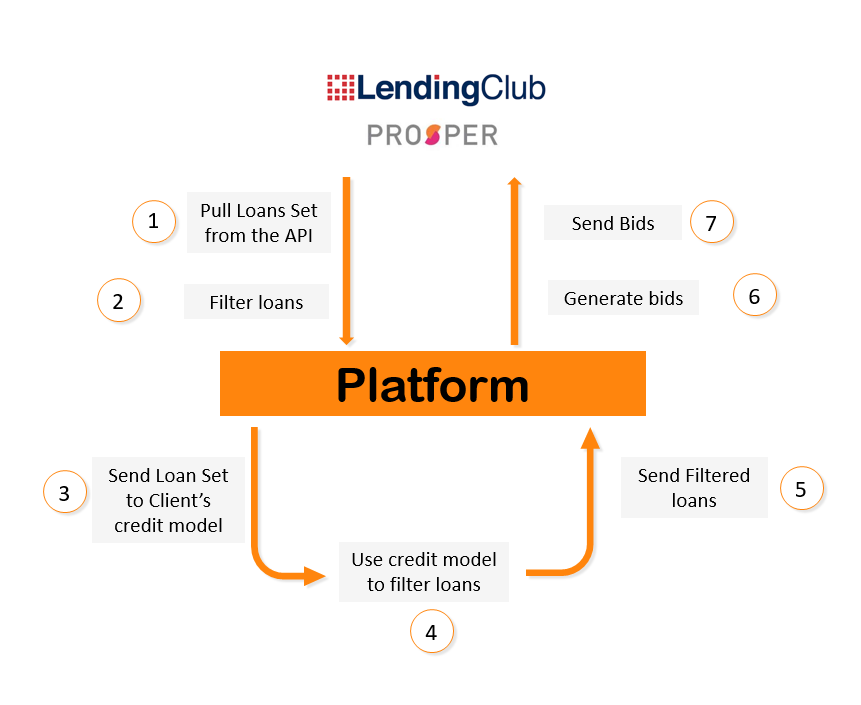

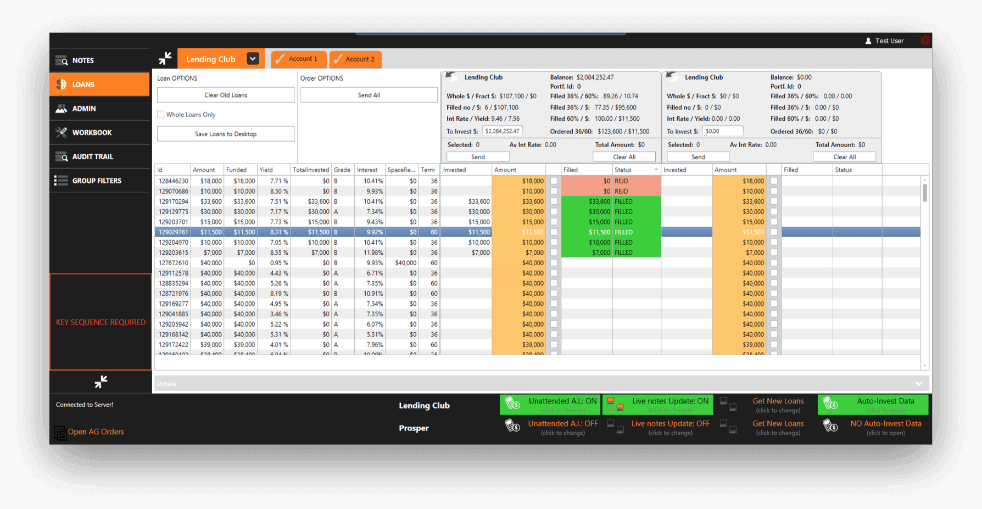

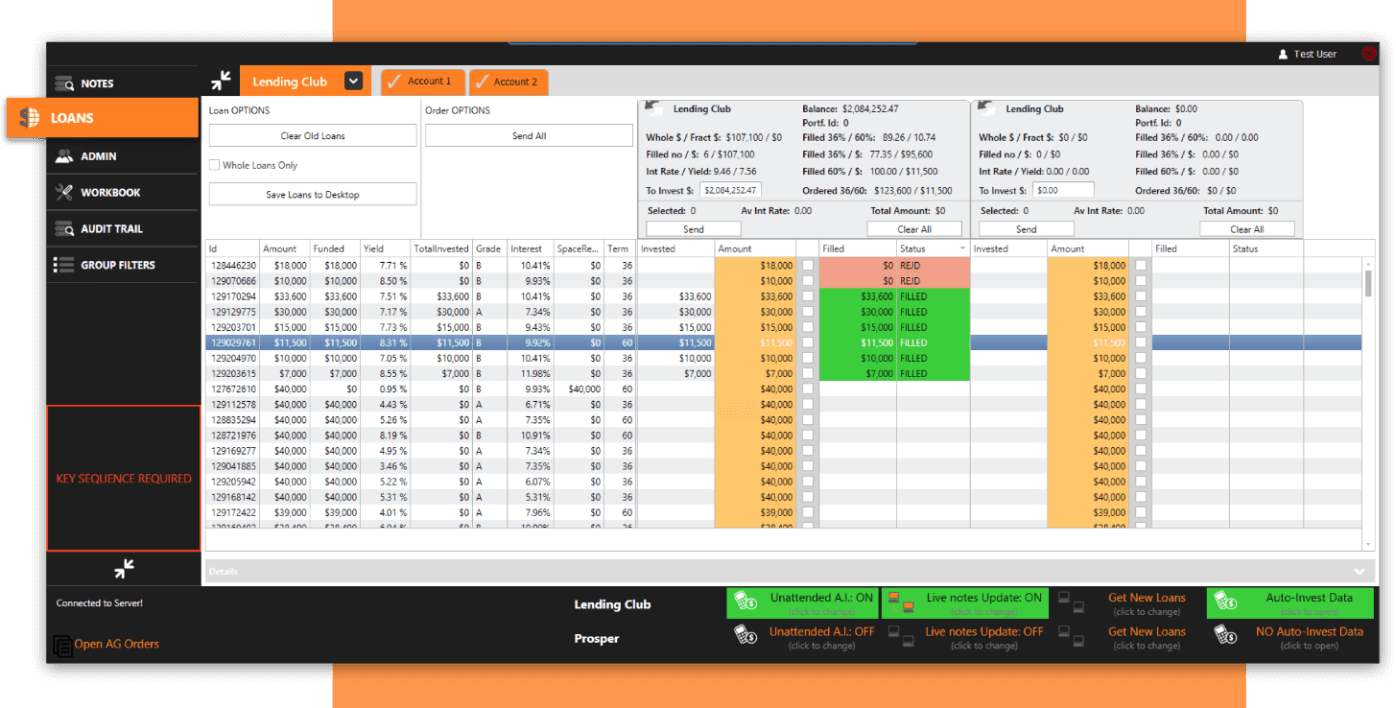

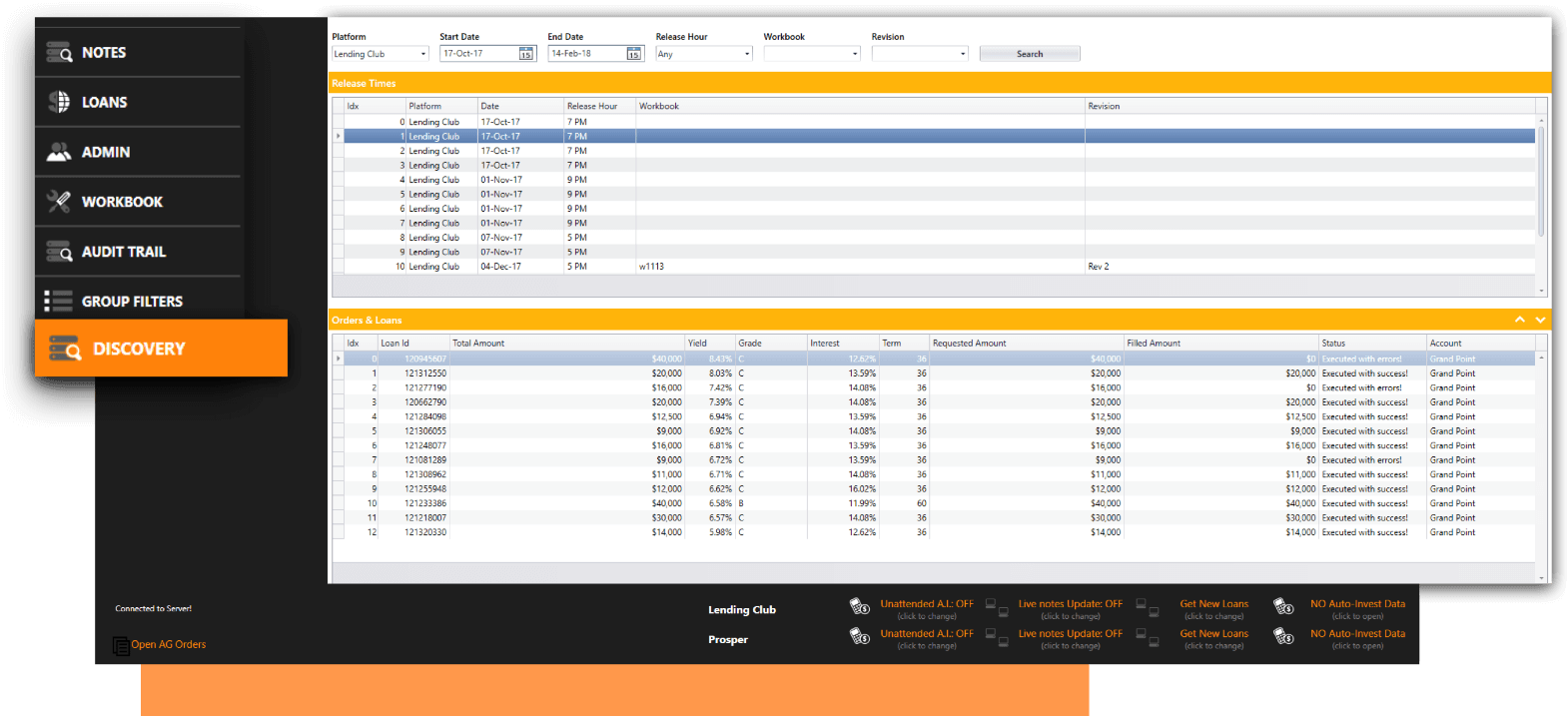

A distributed multi-threaded investment system that automatically receives and filters new listings, calculates risk using the client's algorithms, allocates cash and sends purchase orders, and presents real-time investment reports.

The result? Our client gained control over the entire investment process and the order-fill ratio increased by an astonishing 50%.

Challenge discovery workshop

At the beginning of out collaboration, we have been coordinating with the Pier’s research director to analyze the functional specifications, and understand how the envisioned product will work entirely from the user's perspective.

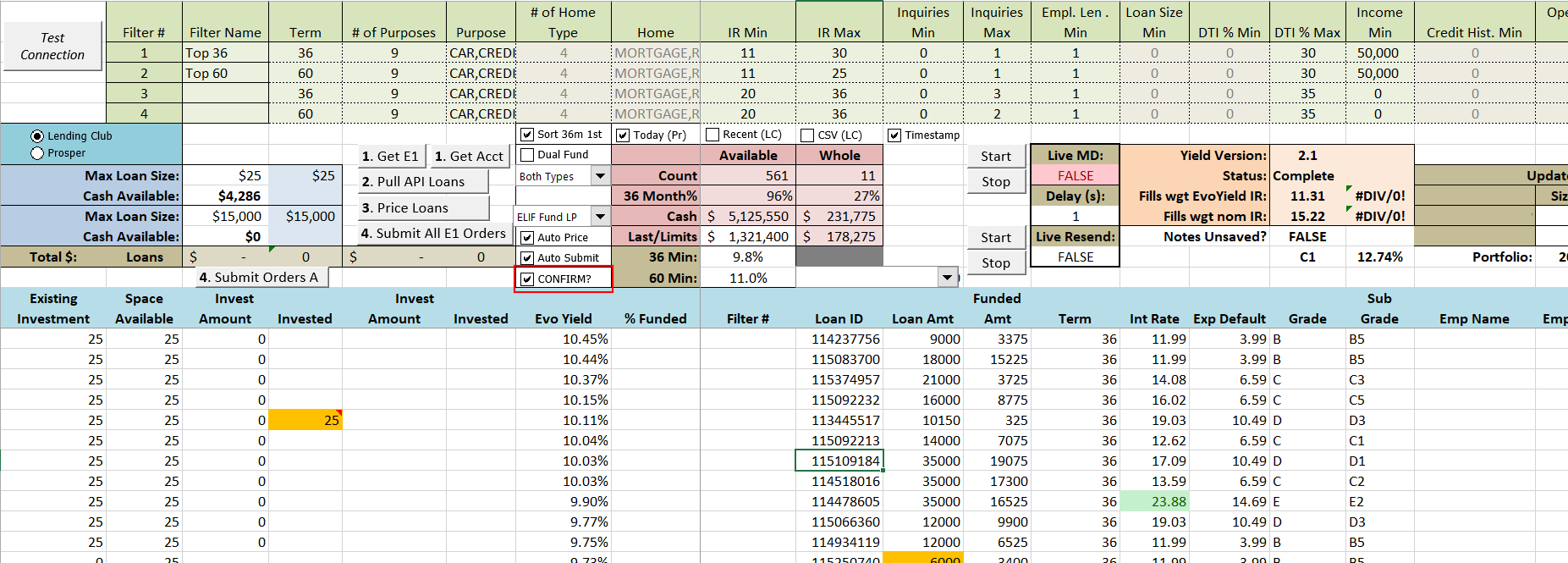

We went through the old Excel application they were initially using and decided on the new features, required screens, data flows, and use cases that would be integrated within the upgraded application.

The original excel spreadsheet institutional investor used to Invest

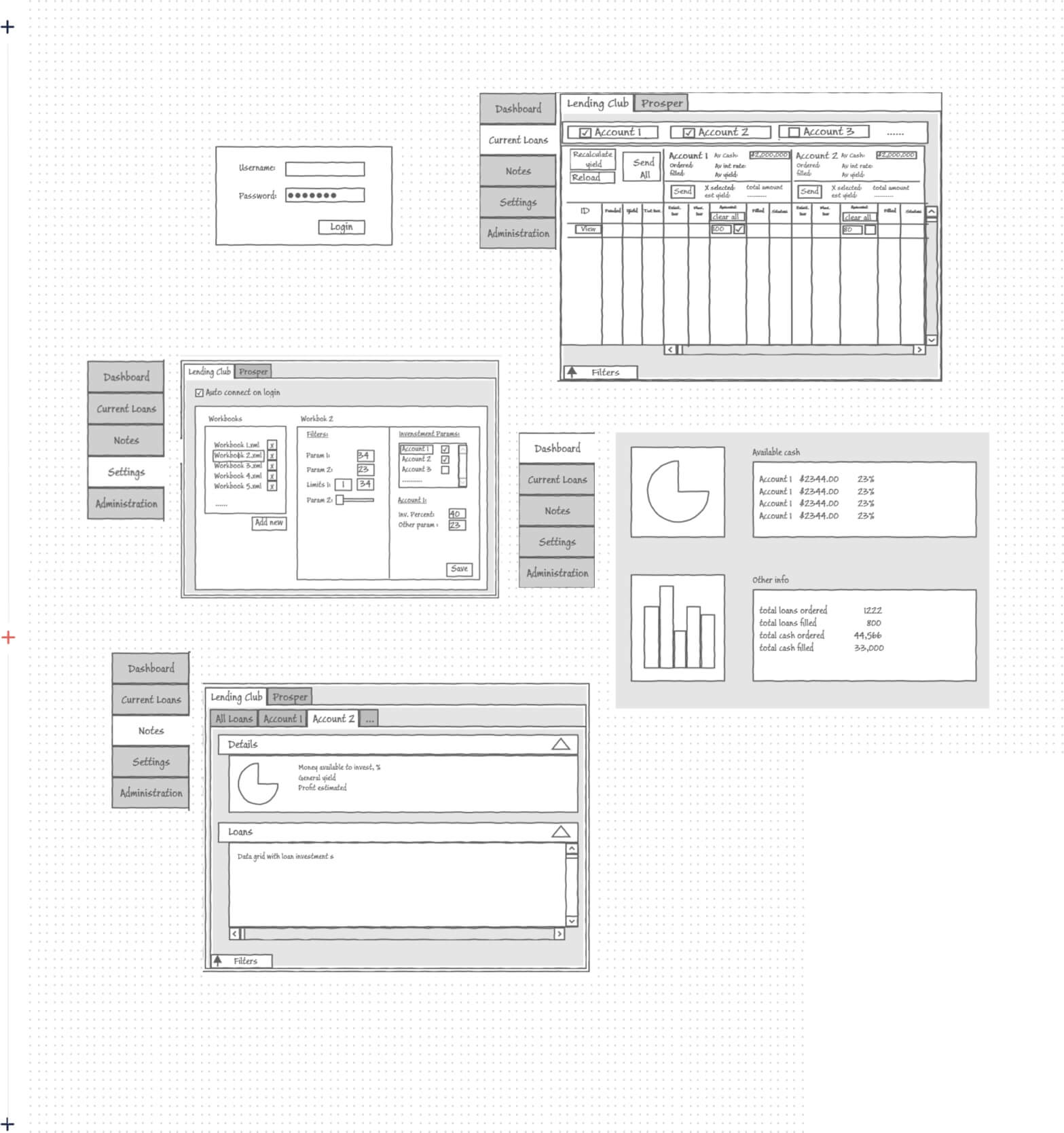

Software Architecture and Mockups

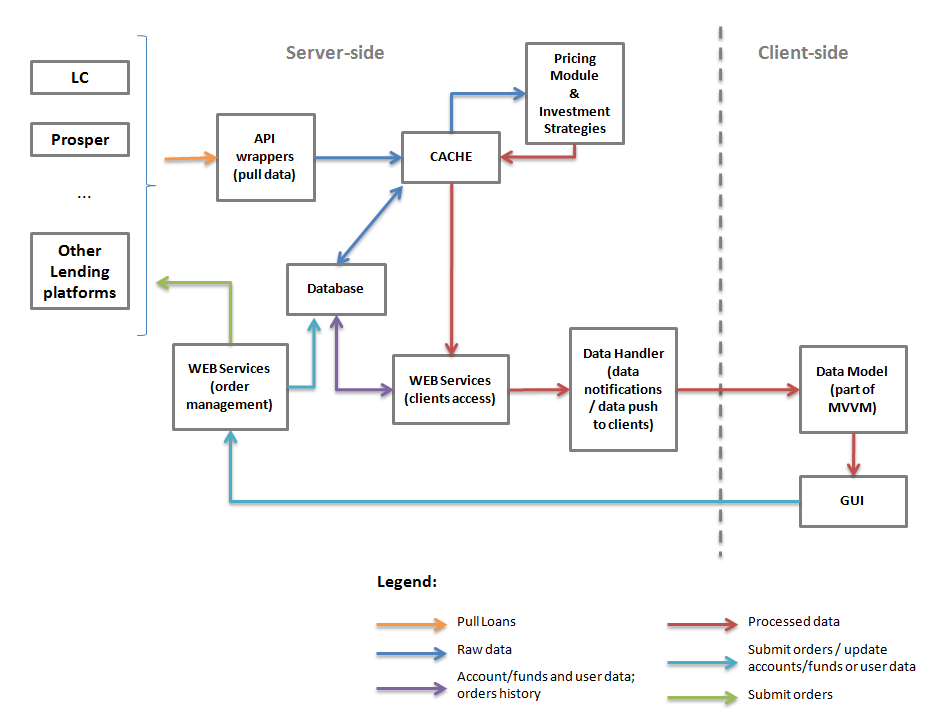

Once we gathered the necessary industry insights and understood the requirements it was our turn to come back with a technical proposal. We have written the technical specification document to describe the internal implementation of the system.

We showcased things like system architecture, data structures, data flows, proposed development phases and design mock-ups.

Implementation

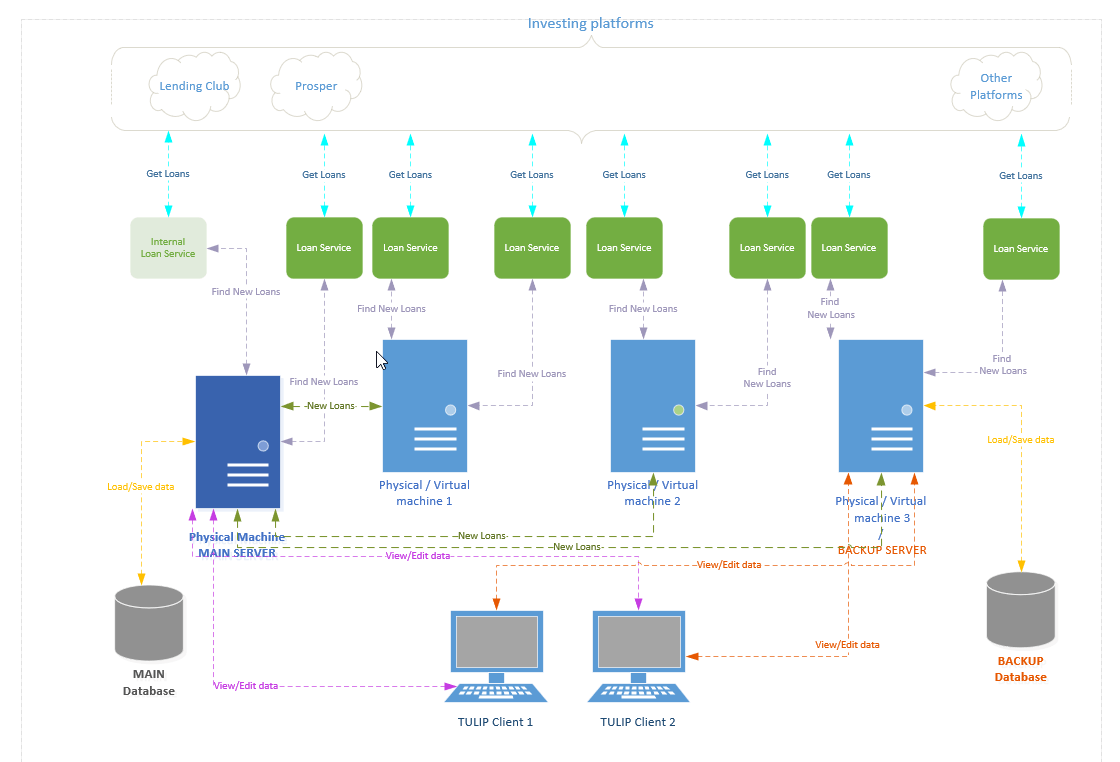

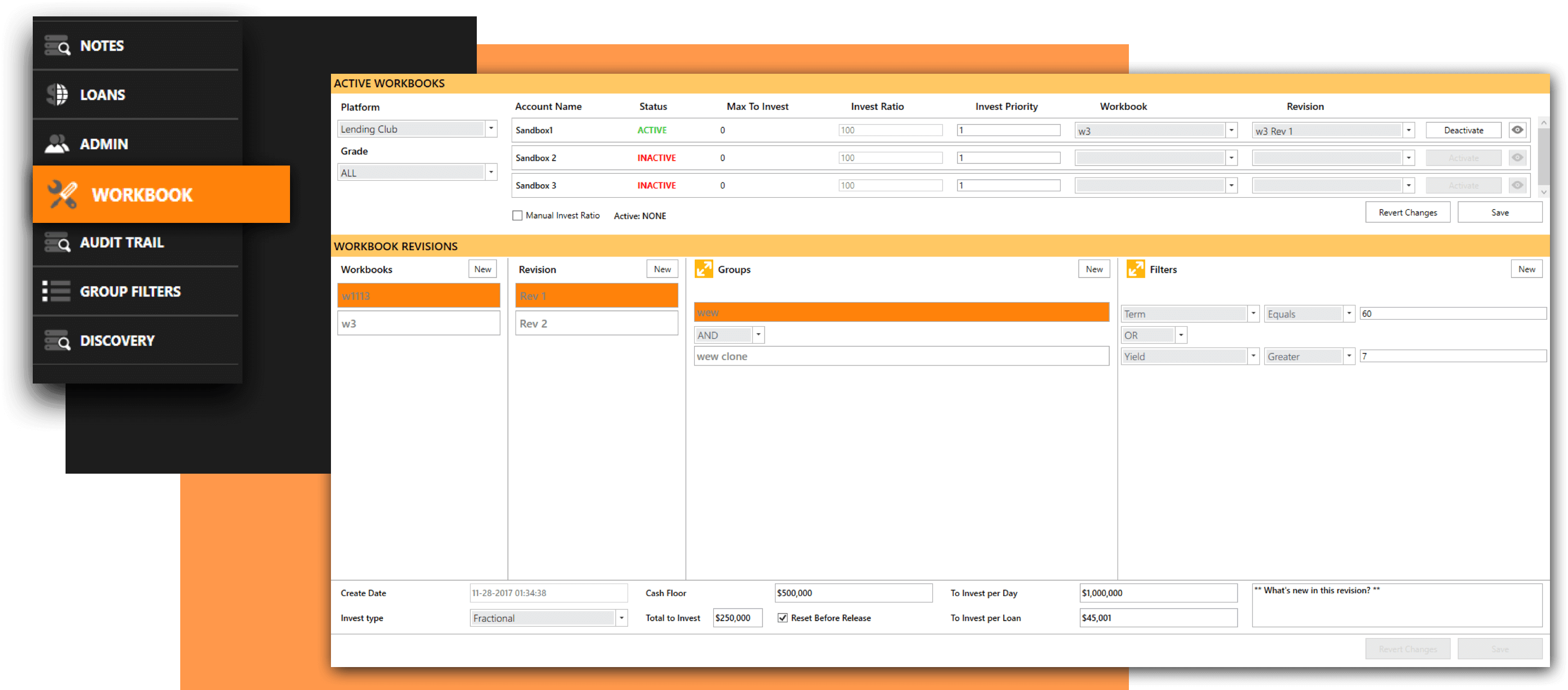

The solution we came up with is an investment platform developed using the Microsoft technology stack, .net Framework and C# as a programming language.

This distributed client-server application consists of a multithreaded backend (data processing and storage servers, distributed applications for API data pulling) and a modern desktop based Graphical User Interface (GUI) developed in Windows Presentation Foundation (WPF)

The platform provides the necessary speed to have competitive advantage in the loan ordering process, assuring loan sets are pulled from the APIs and processed quicker than competitors.

The application pulls the available listings on the market, filters them according to the client’s purchasing criteria, and computes the yield value based on the client’s credit model.

It executes the algorithms in milliseconds, quickly generates orders and sends bids for the most profitable loans on the Lending Club or Prosper platforms.

Additionally, it offers real-time large data visualization and manipulation, for quick reviews and ad-hoc analysis, as well as investment statistics that can be quickly pulled for visualization.

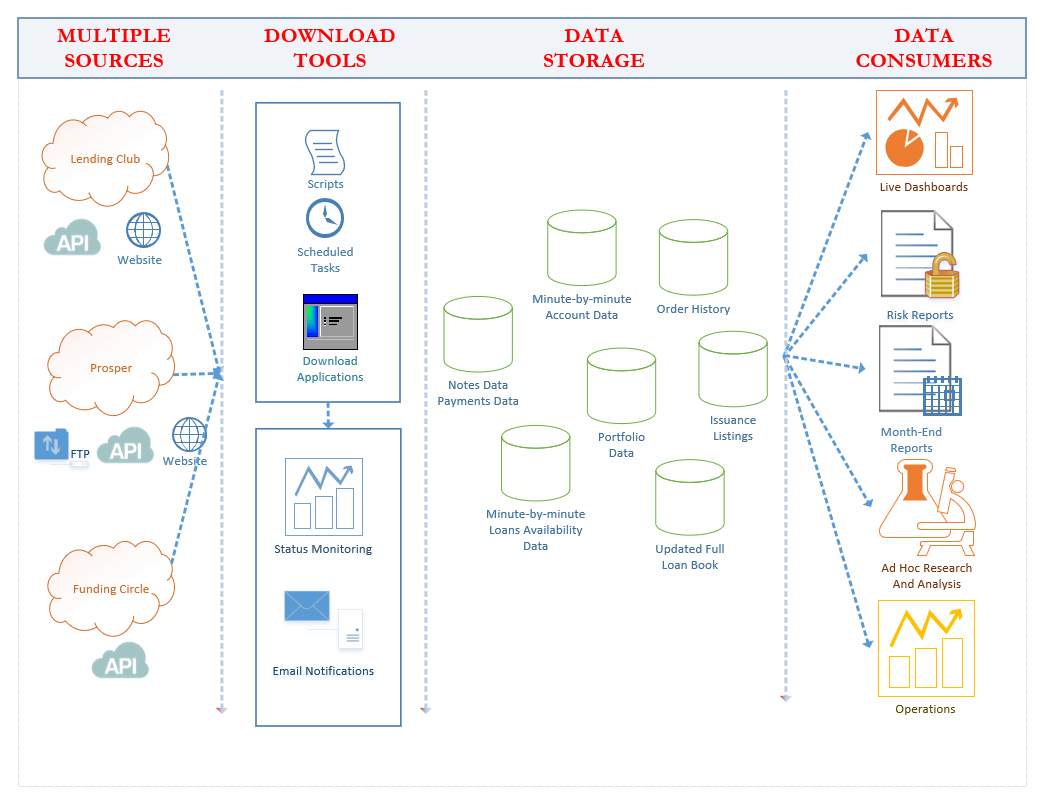

ETL Data Warehouse

Client's second goal was to have an internal database that always has the most up to date versions of:

Each of the platform’s full historical loan books

Note holdings, segmented by platform and account

Minute by minute account info (cash balances, etc)

Portfolio and daily order history

Market data (# of available loans, release sizes, etc)

So we built an entire suite of tools and applications to connect to various sources from different Lending platforms (APIs, FTPs, websites, emails) and extract, collect and load the data into the data-warehouse (ETL).

This data warehouse serves as the institutional-quality back-end for:

all the businesses's ad-hoc analysis

rich business intelligence dashboards

business-critical monthly accounting and client service reporting processes

further studies of all of the stored data to optimize trading

RESULTS

One software tool to view, manage and control the investment in multiple marketplace lending platforms

Better Control - Over the entire investment process, through customization of filters and applying client-defined credit models as well as ad-hoc visualization of analytics.

50% fill ratio increase - The rapid loan assessment and the overall application speed improvement brought a high investment fill ratio increase

More profit & less risk - Investments are made only in the most profitable yet less risky consumer loans by integrating the research-based credit models

Less human error - Significantly lower risk of human error by displaying and rating the loans automatically based on the user-defined criteria

Over $300 million invested - Thanks to the platform’s investment results, our client gained new market share and attracted new funds from family offices and investors

30 minutes saved every day - Tools playing a major role in client's ETL processes have saved significant time through automation of daily downloading and importing of multiple files

Sara Star Villalon

Director of Research

Pier Asset Management

Having worked together for some time now, the relationship has developed so that new projects are easily understood and communicated.

Collaboration and communication is great and has developed so that we are working together and exchanging ideas so that projects are being developed quickly and efficiently.

Got a similar idea?

Let’s talk about how you can implement it!

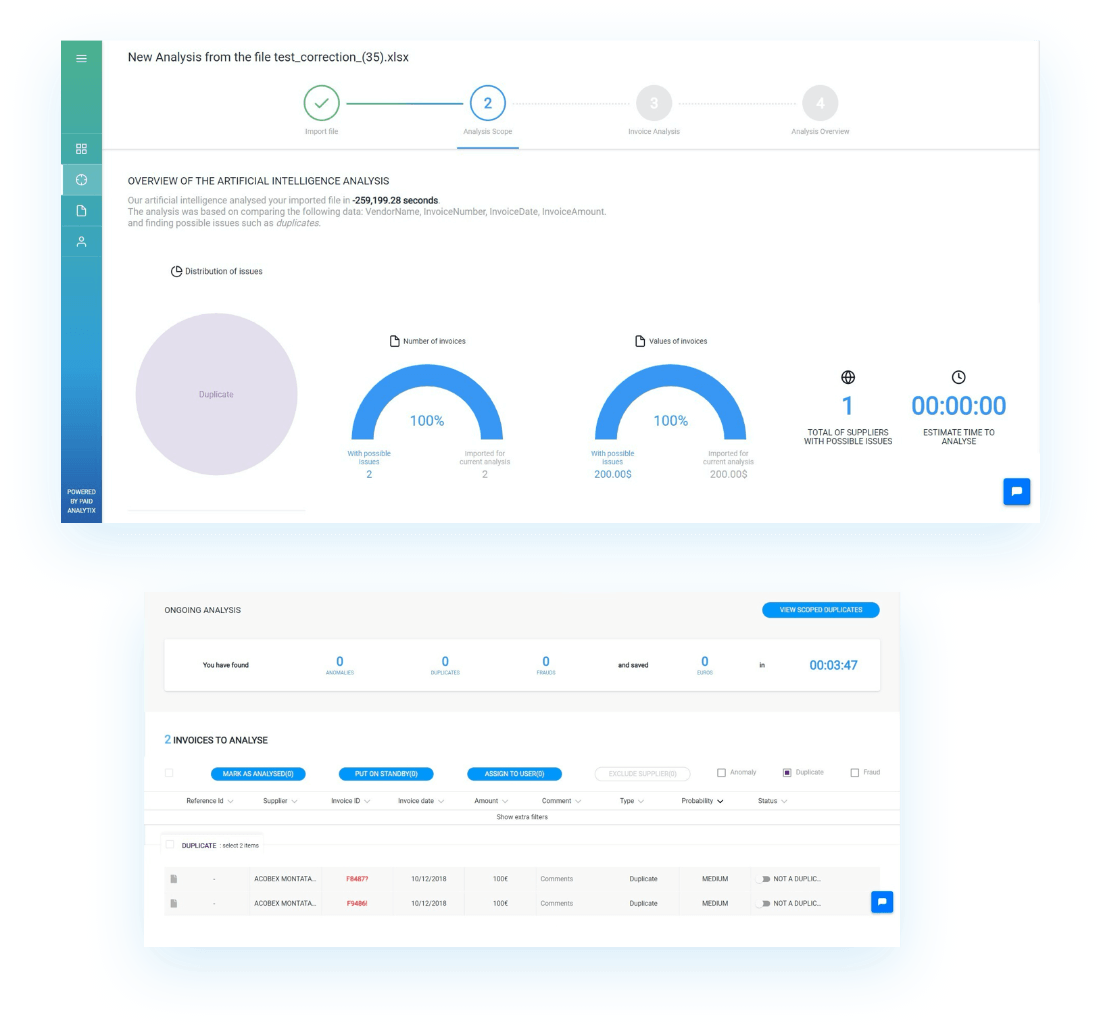

Fintech Tool Helping Enterprises Save up to 1% of Their Payments

Web AI-integrated fintech solution helping medium and large enterprises save millions by eliminating double payments and frauds.